ETH Price Prediction: Will Ethereum Break $4,000 Ahead of Fusaka Upgrade?

#ETH

- Technical Momentum: Bullish MACD crossover supports $4,000 target if 20-day MA is breached.

- Upgrade Catalyst: Fusaka's PeerDAS and scalability features may drive institutional demand.

- Market Sentiment: Short-term bearish pressure contrasts with long-term bullish fundamentals.

ETH Price Prediction

ETH Technical Analysis: Key Levels to Watch

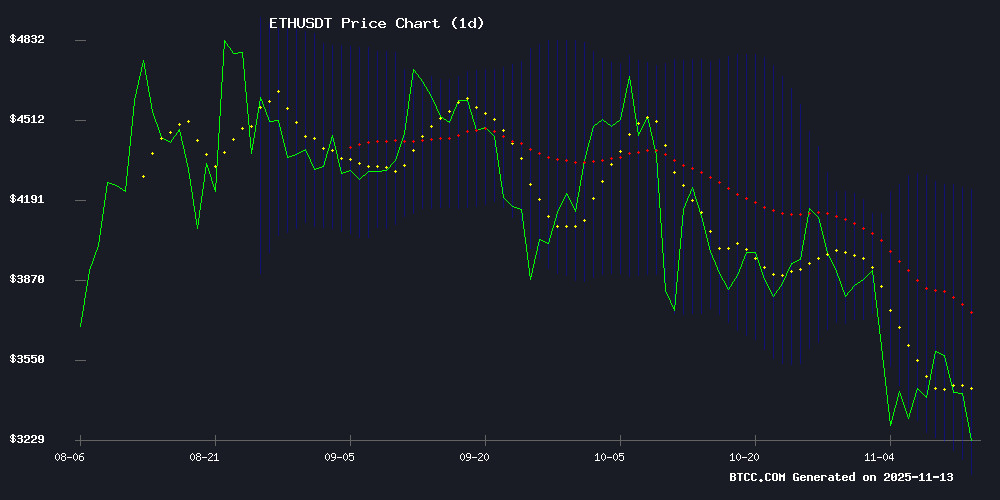

According to BTCC financial analyst Sophia, ethereum (ETH) is currently trading at $3,424.92, below its 20-day moving average (MA) of $3,671.24. The MACD indicator shows a bullish crossover with a reading of 56.3352, suggesting potential upward momentum. Bollinger Bands indicate a range between $3,125.36 (lower band) and $4,217.12 (upper band), with the middle band at $3,671.24 acting as a pivot. Sophia notes that a break above the 20-day MA could signal a rally toward $4,000.

Ethereum Defies Bearish Sentiment Amid Fusaka Upgrade Hype

BTCC analyst Sophia highlights Ethereum's 3.18% surge despite broader market fears, attributing the resilience to institutional interest and the upcoming Fusaka upgrade in Q4 2025. The upgrade, featuring PeerDAS and scalability enhancements, is fueling bullish sentiment. Sophia cautions that while short-term volatility may persist, the long-term outlook remains positive given Ethereum's fundamentals.

Factors Influencing ETH’s Price

Ethereum Defies Market Fear with 3.18% Surge Amid Bearish Sentiment

Ethereum outpaced Bitcoin and the broader crypto market with a 3.18% gain, trading at $3,533.37 despite lingering bearish sentiment. The Fear & Greed Index remains at 15—Extreme Fear—yet long-term investors continue accumulating ETH.

Year-to-date, Ethereum retains a 12.78% increase despite a 12.43% monthly decline. Analysts project a potential 10.37% rally to $3,814.97 within five days, though prices remain 7.12% below November 2025 targets.

The asset’s resilience contrasts with its August 2025 peak of $4,946.50. Market watchers note institutional accumulation continues unabated, suggesting confidence in Ethereum’s fundamentals outweighs short-term volatility.

Why Ethereum Still Fascinates Financial Institutions

Joseph Chalom, former head of digital assets at BlackRock, has made a bold declaration: Ethereum will serve as the foundational infrastructure for Wall Street's digital future. This assertion comes amid market turbulence, with ETH breaking below the $3,600 support level and eyeing a potential drop to $3,300.

Sharplink, Chalom's current venture, holds over $3 billion in Ethereum and actively stakes these assets. Institutional adoption accelerates as Ethereum becomes the platform of choice for stablecoins, tokenized assets, and smart contracts—despite recent price volatility.

The market's confidence appears unshaken. Major financial players continue betting on Ethereum's long-term viability, viewing current price fluctuations as noise against the blockchain's structural role in global finance.

Ethereum Announces Fusaka Upgrade for Q4 2025, Introducing PeerDAS and Enhanced Scalability

Ethereum's Fusaka upgrade, scheduled for Q4 2025, promises to revolutionize the network's scalability and efficiency. The upgrade will integrate PeerDAS (Peer Data Availability Sampling), a breakthrough in data handling that reduces storage requirements for nodes while maintaining security. This innovation is expected to significantly lower costs for Layer 2 solutions.

The Fusaka hard fork combines improvements to both the execution and consensus layers, building on the foundation laid by Pectra. Enhanced safety limits and transaction speed optimizations position Ethereum to meet growing global demand without compromising its decentralized ethos.

Market analysts anticipate the upgrade could trigger renewed institutional interest in ETH, particularly as the network addresses longstanding challenges around throughput and operational costs. The development team emphasizes this upgrade represents a carefully balanced approach to scaling - one that preserves Ethereum's core values while embracing necessary evolution.

Ethereum Price Tests Key Support Ahead of Fusaka Upgrade

Ethereum faces renewed volatility as its price retests the $3,450 support level, a critical threshold that could determine its short-term trajectory. Market participants remain divided—some view this consolidation as a foundation for the next rally, while others caution that a breakdown could trigger deeper corrections.

The $3,450 level has emerged as a make-or-break zone. Holding above it may pave the way for a rebound toward $3,715 resistance, while failure could expose ETH to further downside. Traders await clarity from the December 3 Fusaka upgrade, which could set the tone for Ethereum's 2025 outlook.

Sideways action between $3,450 and $3,715 reflects market indecision. The coming weeks will reveal whether buyers can defend this support or if bears gain control. All eyes remain on Ethereum's ability to maintain this crucial technical level amid evolving market dynamics.

Will ETH Price Hit 4000?

Sophia from BTCC suggests ETH's path to $4,000 hinges on reclaiming the 20-day MA ($3,671.24) as support. Technicals show bullish MACD momentum, but resistance at the upper Bollinger Band ($4,217.12) may cap gains. The Fusaka upgrade news could act as a catalyst. Key levels to watch:

| Indicator | Value |

|---|---|

| Current Price | $3,424.92 |

| 20-Day MA | $3,671.24 |

| Upper Bollinger Band | $4,217.12 |